Table Of Content

With Chase for Business you’ll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and managing payroll. Choose from business checking, business credit cards, merchant services or visit our business resource center. If you're refinancing your home, enter the current mortgage balance. Ideally, your balance should be less than 80% of your home value to qualify for the best interest rate. If you're applying for a cash-out refinance, enter the additional amount you want to borrow, too.

Mortgage Calculator Components

April was the last month of full program benefits, but households could receive a partial discount in May. Four years ago, Claudia Aleman and her family had only one way to get online — through their cellphones. Pokemon cards have seen a "massive surge", Tracy says, with people paying "thousands and thousands of pounds" for good unopened sets. The predictions come just as the rate of price increases on many food items begins to slow as inflation falls.

Monthly Payment Calculation

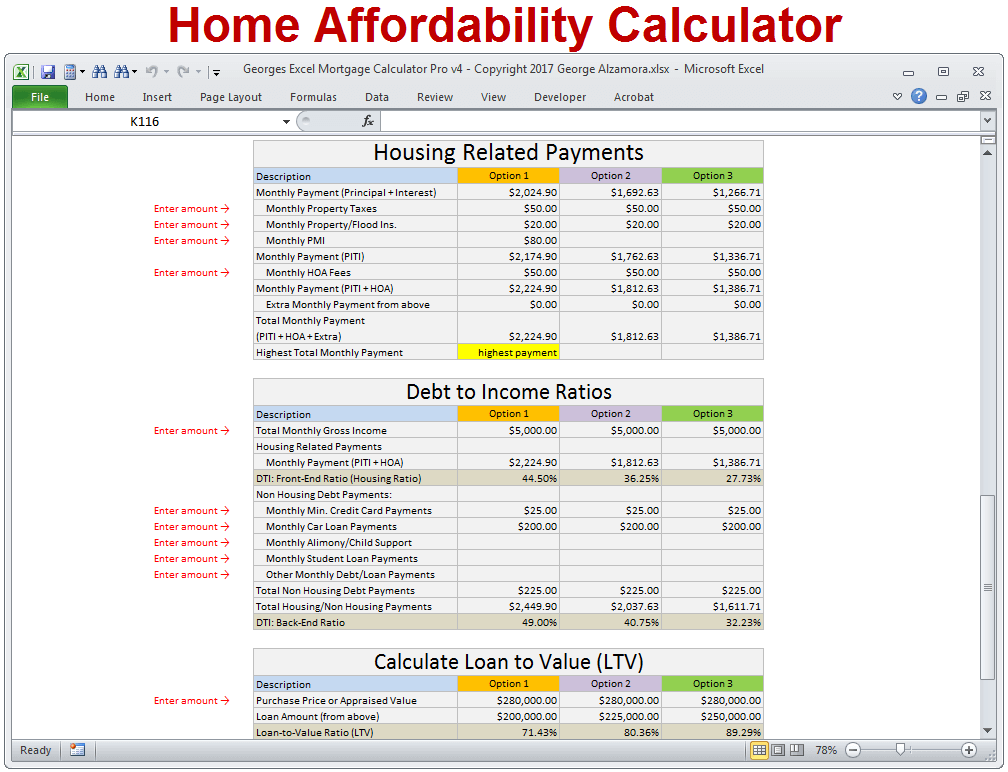

Depending on the type of home loan you want, the home value, mortgage balance, down payment and cash amount may factor into your LTV. Mortgage calculators can be used for many different types of mortgages, including government-backed loans or adjustable-rate mortgages. Just be sure to account for any additional costs the calculator doesn't include (like FHA mortgage insurance, for example). A mortgage calculator can give you an estimate of how much you might pay each month for a mortgage based on the home price, the size of your down payment, the loan term length, and your interest rate. The free Business Insider mortgage calculator shows how much you'll pay each month based on your home price, down payment, term length, and mortgage rate. We also provide customized tips on how to save money on your mortgage.

How to use the mortgage calculator

Whether you're thinking about buying your first home or you're ready to refinance your current house, a mortgage calculator can help you understand your monthly payment. It's important to understand how your interest rate, down payment, property location, term and other factors can affect your mortgage payment. Find out how to use a home loan calculator and see how this tool can make calculating your estimated mortgage payment easier. The answer depends on several factors including your interest rate, your down payment amount and how much of your income you’re comfortable putting toward your housing costs each month. Assuming an interest rate of 6.9% and a down payment under 20%, you’d need to earn a minimum of $150,000 a year to qualify for a $400,000 mortgage.

A homeowner’s association is an organization in a planned community that maintains and reinforces rules for the properties in its jurisdiction. By purchasing a property in such a community, the homeowner is agreeing to the HOA’s rules and fees. HOAs maintain a significant amount of legal power over property owners regarding the outside conditions of the home.

If you see unauthorized charges or believe your account was compromised contact us right away to report fraud. Be sure to check for additional programs in different regions and counties across California. In some cases, these local programs might be open to both first-time and repeat homebuyers. Use Rocket Mortgage® to see your maximum home price and get an online approval decision. By 2001, the homeownership rate had reached a record level of 68.1%.

You’re our first priority.Every time.

Loan start date - Select the month, day and year when your mortgage payments will start. If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum.

Mortgage Calculator: PMI, Interest & Taxes - The Motley Fool

Mortgage Calculator: PMI, Interest & Taxes.

Posted: Thu, 09 Nov 2023 08:00:00 GMT [source]

Most recurring costs persist throughout and beyond the life of a mortgage. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations.

Mortgage Rates by Loan Type

This can help the borrower pay off their mortgage loan sooner and reduces the total amount of interest paid over the life of the loan. The monthly mortgage payment on a $300,000 house would likely be around $1,980 at current market rates. That estimate assumes a 6.9% interest rate and at least a 20% down payment, but your monthly payment will vary depending on your exact interest rate and down payment amount. Use Bankrate's mortgage calculators to compare mortgage payments, home equity loans and ARM loans. Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

Loan limits change annually and are specific to the local market. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance. Internet service providers have their own programs for low-income households.

The amount you pay each month for your mortgage, homeowner’s insurance, and HOA fees. This payment should be no more than 25% of your monthly take-home pay. That leaves plenty of room in your budget to achieve other goals, like saving for retirement or putting money aside for your kid’s college fund.

The calculator auto-populates the current average interest rate. The lower your rate, the more you'll be able to borrow, so shop around and get preapproved with multiple mortgage lenders to see who can offer you the best rate. But remember not to borrow more than what your budget can comfortably handle. Sky high mortgage rates have pushed many hopeful buyers out of the market, slowing homebuying demand and putting downward pressure on home prices. The current supply of homes is also historically low, which will likely push prices up.

A lot of factors go into that assessment, and the main one is debt-to-income ratio. Under "Down payment," enter the dollar amount of your down payment (if you’re buying) or the amount of equity you have (if refinancing). Or instead of entering a dollar amount, enter the down payment percentage in the window to the right. A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology.

If the ZIP code includes more than one county, the home loan calculator will prompt you to choose the correct one. The mortgage calculator requires the ZIP code and the county in order to identify the right property tax rates. If you're buying a home, enter the down payment you plan to make. You can either enter the dollar amount or the percentage of the home price. If you enter the amount, the percentage automatically calculates, and vice versa.

Most lenders include one-twelfth of your annual property tax in each monthly mortgage payment. Based on your input, a mortgage calculator provides home loan options and estimates. These calculators are helpful when you want to see estimates for different types of mortgages you might qualify for, or if you want to see how different loan terms would affect your monthly payments. The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. A 20% down payment typically allows you to avoid private mortgage insurance (PMI). The higher your down payment, the less interest you pay over the life of your home loan.

No comments:

Post a Comment